|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Understanding Dog Insurance: Common Mistakes to AvoidIn the vibrant world of pet ownership, ensuring the well-being of our canine companions is paramount, and as more people become enlightened about the benefits of dog insurance, it's vital to navigate the intricacies of this often perplexing domain with an informed lens. As a responsible pet owner, you may find yourself inundated with choices, each promising peace of mind and comprehensive care, yet, understanding the potential pitfalls is crucial to making a decision that genuinely serves your four-legged friend. Firstly, it is imperative to thoroughly scrutinize the policy details. Many fall into the trap of assuming all dog insurance policies are created equal, but this is a misconception. Coverage can vary significantly from one provider to another, and failing to read the fine print may result in unexpected expenses. For instance, some policies might exclude pre-existing conditions or certain breeds prone to hereditary ailments, leaving owners in a lurch when they need support the most. Hence, a meticulous review of what is and isn’t covered is essential. Moreover, another common oversight is overlooking the deductible and co-payment structure. Insurance jargon can be dizzying, yet understanding terms like 'deductible'-the amount you pay out-of-pocket before your insurance kicks in-and 'co-payment'-the percentage of the vet bill you’re responsible for-can significantly affect your out-of-pocket expenses. Opting for a lower premium might be tempting, but it often comes with higher deductibles and co-pays, which could be financially straining during an emergency. Additionally, some pet owners mistakenly believe that their dog's age and health status won't affect their premiums, only to be caught off guard by increasing costs as their pet ages or if health issues arise. It’s wise to anticipate these adjustments and choose a policy that offers stability and predictability over time. Furthermore, neglecting to compare providers is another frequent misstep. In a market brimming with options, dedicating time to compare various insurers can lead to better deals and more comprehensive coverage. Many resources and comparison tools are available online to aid this process, ensuring that you find a plan tailored to your dog's specific needs. Beyond these logistical considerations, it’s equally important to consider the insurer's reputation and customer service track record. An insurer might offer an attractive package on paper, but if their customer service is lacking or claims process is notoriously cumbersome, it could lead to frustration and delayed care for your pet. Reading reviews and seeking recommendations from fellow dog owners or veterinarians can provide invaluable insights. Finally, the emotional aspect should not be underestimated. Owning a dog is not merely a financial commitment but an emotional journey, and having the right insurance can alleviate some of the stress and uncertainty that accompanies pet healthcare decisions. By avoiding these common mistakes and approaching the process with diligence, you can ensure that your furry companion receives the best care possible without unnecessary financial strain, allowing you to focus on what truly matters-cherishing each moment with your beloved pet. https://www.petmd.com/dog/general-health/insurance-for-dogs

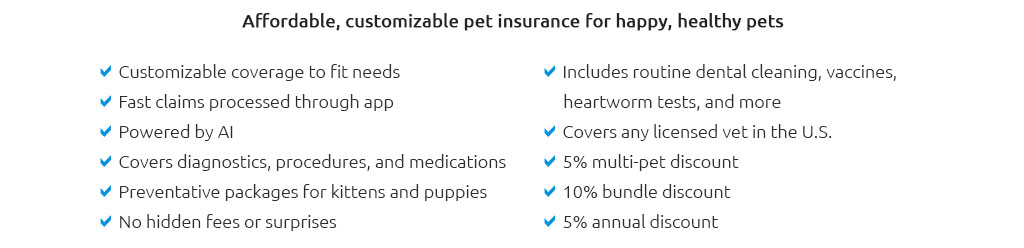

Getting your fur baby the best pet health insurance possible is a great way to protect your dog, and it can help you control costs of expensive veterinary care. https://www.usnews.com/insurance/pet-insurance/what-is-pet-insurance

What Is Pet Insurance? Pet insurance reimburses you for a percentage of veterinary expenses relating to your pet's illness or injury, depending ... https://www.progressive.com/pet-insurance/

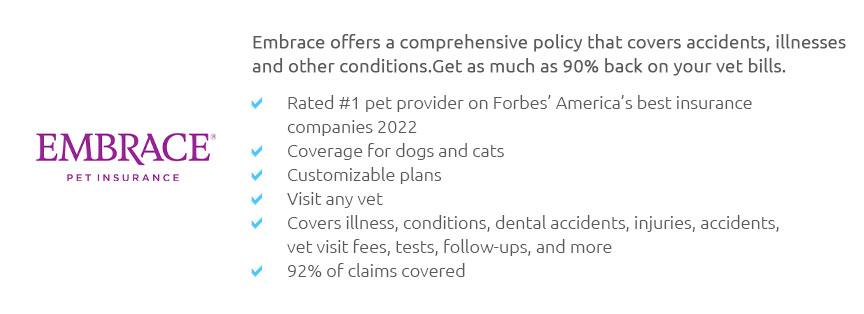

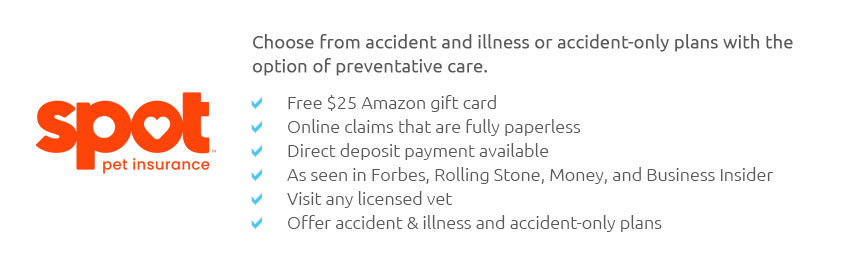

Accidents and illnesses. Companion Protect and Pets Best offer plans that cover both injuries and illnesses, no matter how serious. These comprehensive plans ...

|